Budget Range

- What is our budget per deal or annually?

- Do we prefer flexible or fixed pricing?

- Can we invest in advanced features?

Choose pricing models based on budget size and need for cost predictability.

| Data Room Provider | Starting price (per month) | Pricing Model | Notable Features | Free Trial |

|---|---|---|---|---|

| Ideals |

Contact the provider

Get price |

Flat rate |

|

30 days |

| DealRoom | $1,000 | Flat rate |

|

✔️ |

| Ansarada | $479 | Storage-based |

|

✔️ |

| Brainloop | Contact the provider | — |

|

✔️ |

| Intralinks | Contact the provider | — |

|

✖️ |

Because pricing isn’t one-size-fits-all. It varies based on the provider you choose and on the specifics of your deal, feature needs, data volume, and project duration.

This flexibility is helpful. However, it can make it difficult to estimate costs without a closer examination of how pricing models work.

After reading this guide, you will understand how different pricing structures work, what is typically included in the cost, and how to align your choice with your budget and deal type. Also, you will learn how to approach pricing discussions with a provider from an informed position.

Below is a breakdown of the most common structures, how VDR providers charge, and the pros and cons of each pricing model:

| Pricing Model | Description | Advantages | Limitations | Typical Use Cases |

|---|---|---|---|---|

| Per-page pricing | The provider charges based on the number of documents or pages uploaded to the data room. |

|

|

Early-stage startups or small deals with limited documentation. |

| Per-user pricing | The provider charges according to the number of users who have access to the virtual data room. |

|

|

Early-stage fundraising or internal review projects. |

| Flat rate pricing | The provider offers a flat monthly fee for ongoing use of the data room regardless of storage or users. |

|

|

Ongoing investor relations or frequent due diligence processes. |

| Per-project pricing | The provider charges a one-time fee for access to a data room during a specific project. |

|

|

M&A transactions, one-time capital raises, or single asset sales. |

| Tiered pricing | The provider offers customized pricing based on required features, number of users, and storage volume. |

|

|

Private equity firms, venture capital groups, or large enterprises with multiple deals. |

As you can see, investor data room pricing can follow several structures, each suited to different deal types, team sizes, and durations. To compare providers and avoid unexpected expenses, check what you get for this price.

Virtual data room providers offer similar pricing tiers but include different levels of service, functionality, and limitations. Below are the core components that a standard VDR plan typically offers and key areas where additional fees may apply.

Plans typically include a predefined amount of secure cloud storage, ranging from a few gigabytes to several terabytes. It is usually sufficient for financial documents, cap tables, legal contracts, and pitch decks. Higher-tier virtual data room options often offer scalable or unlimited storage capacity, whereas entry-level plans typically include strict storage limits.

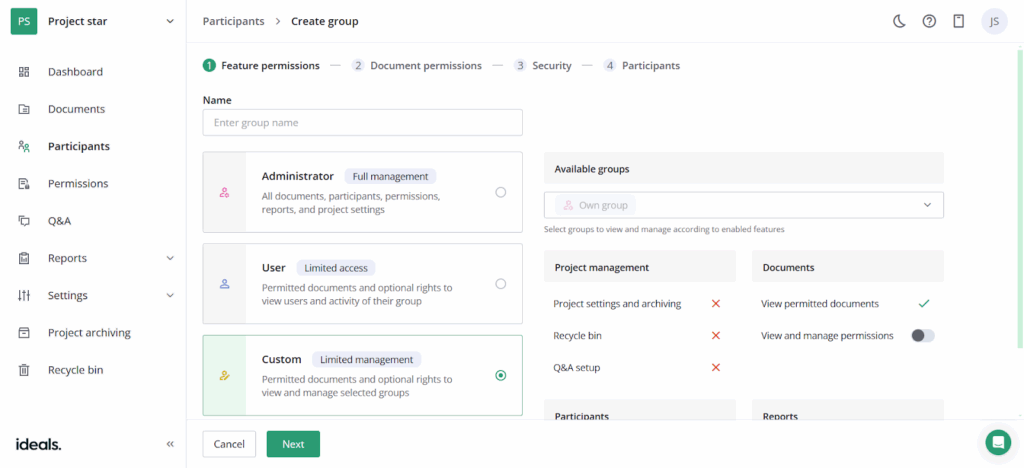

Commonly, providers include a set number of user accounts, with some limiting access by role or charging extra for additional users. Some providers offer unlimited users.

Strong data protection and secure document sharing are core offerings in any VDR platform. Standard protections include two-factor authentication, end-to-end encryption, granular user permissions, and dynamic watermarking. These tools are critical for maintaining confidentiality and advanced security in investor communications.

Granular user permissions

Most plans include email or live chat support during business hours. More advanced enterprise-level subscriptions often offer 24/7 support, onboarding assistance, and dedicated account managers. Some also provide multilingual support and live deal coordination assistance.

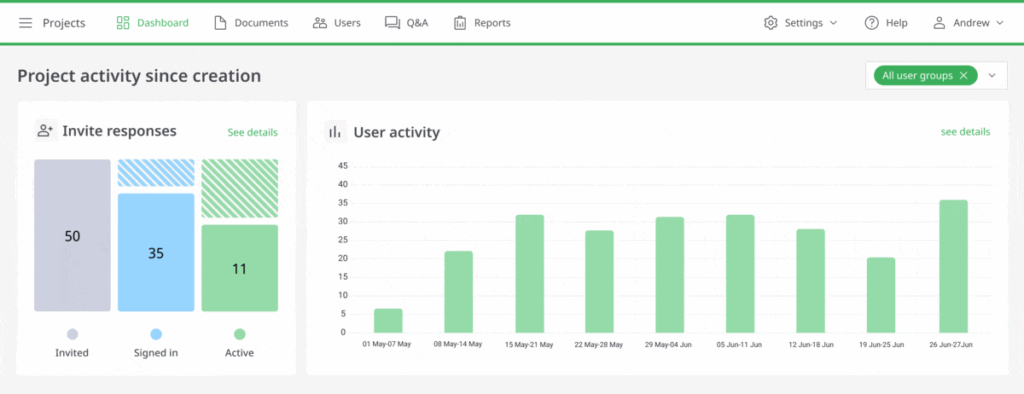

Audit logs track who accesses sensitive documents, when, and what actions they take. These insights enable deal coordinators to monitor investor engagement and ensure compliance with disclosure policies.

Data room activity tracking

Virtual data rooms used for investor relations or fundraising typically meet global security and privacy standards, including the following:

Some virtual data room solutions also offer built-in tools for legal hold, automated redaction, and regulatory archiving to support industry-specific compliance (e.g., financial or healthcare).

The following are common surcharges that can impact the total virtual data room cost:

Next, check the most important things to consider when choosing a solution.

Data room selection goes beyond comparing sticker prices. Below are the key factors to evaluate and questions to answer when matching a VDR to your needs:

Choose pricing models based on budget size and need for cost predictability.

Low volume suits pay-per-project; high volume benefits from subscriptions.

Small teams can opt for limited seats; larger groups need scalable plans or unlimited users.

Confidential documents demand advanced controls and compliance support.

Advanced features improve efficiency and workflow integration.

Strong support ensures smoother adoption and faster ROI.

Prioritize vendors who demonstrate:

To help you understand how different investor types choose virtual data rooms, we provide some example profiles. These illustrate typical deal volumes, security needs, and budget considerations to guide your selection of the most suitable VDR plan.

This investor handles a high volume of smaller deals with frequent due diligence cycles. A pay-per-project or entry-level subscription plan with moderate user seats and standard security is often sufficient for most organizations. They prioritize cost-efficiency and ease of setup over advanced features.

With fewer but larger deals, this firm benefits from a tiered subscription plan offering scalable storage and user seats. Stronger security controls and compliance tools are crucial due to the sensitivity of financial and legal data. Analytics and integrations with CRM or portfolio management software enhance workflow efficiency.

Advisors facilitating M&A deals require strong security virtual data rooms with dynamic watermarking, advanced permission settings, and legal hold capabilities. Temporary, per-project pricing is preferred, with the flexibility to scale user access and provide audit logs for compliance and reporting purposes.

With a clear understanding of your needs and usage patterns, we can now move into pricing discussions with your provider.

Here are expert recommendations to help you secure significant cost savings and maximize value:

| Tip | Description | Questions to Ask |

|---|---|---|

| Ask for a free trial or extended demo | A trial allows you to evaluate the platform’s usability, security, and collaboration tools before committing. | Can we test the platform with a live project or simulated deal before purchase? |

| Negotiate bundled pricing for multiple deals | Firms running several deals annually may qualify for volume discounts or multi-project packages. | Do you offer pricing for firms running multiple transactions per year? |

| Choose feature-based pricing over per-page fees | Feature-based models are often more transparent and cost-efficient for mid-size or large teams. | Is pricing based on storage, features, or usage volume? |

| Clarify auto-renewal and overage policies | Many contracts renew automatically or charge for exceeding data or user limits—clarify these before signing. | Does the contract auto-renew? What happens if we exceed our data or user limits? |

| Ask about customization and add-ons | Some platforms charge extra for branding, customization, or API integrations—make sure these are clear upfront. | Is custom branding included in our plan? What is the cost for additional modules? |

Virtual data room pricing plays a significant role in choosing the software. However, it is only part of the equation. Usability, security, compliance, scalability, and the quality of customer support can impact your deal as much.

If you’re still unsure which solution fits your needs, explore in-depth provider comparisons and real user insights to evaluate platforms based on price and their performance.

Ready to find the right fit? Read full reviews to find the best VDR value for your deals.